Introduction

In Finacle,

every customer is identified by Customer Information File(CIF) number (9

digit). As CIF ID was not available in sanchaypost, each and every account was

migrated with separate CIF with instructions to merge CIF (Post Migration).

CIF merger

is the process of merging all accounts of a particular persons under one single

CIF.

Business scenario for CIF merger

a) Same customer was migrated with more

than one CIFs depending on number of accounts. One CIF is to be retained as

master CIF and all accounts of that customer to be merged with master CIF.

b) Linking of Aadharnumber to single CIF

ID.

c) Crediting of TDA maturity proceeds

to POSB account under same CIF.

1.

CDEDUP – Deduplication – A customer can be identified

by either of these fields

last name, first name, middle name, passport, driving

license, PANNO, Driving license, date of birth.

2.

CMRC: Inquiry option - Click on Searcher at

CIF ID field and enter the required details in

the searcher field.

3.

CCIFINQ: Searcher

based on mobile / aadhar number

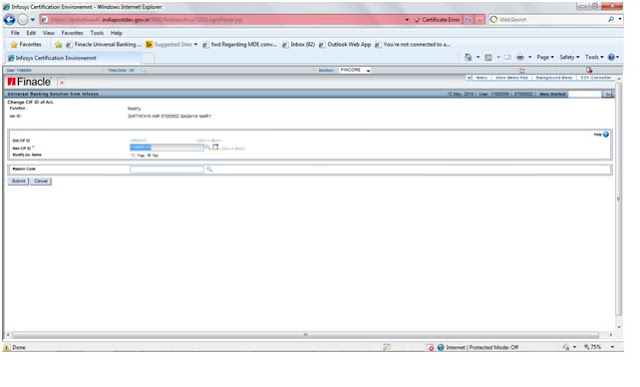

Procedure for CIF merger

1)

Invoke

the menu HCCA through CPA Login

2)

Select

the function MODIFY

3)

Enter

the account number for which CIF merger is initiated

4)

Click

on GO

The

following fields are to be updated

a) Old CIF ID along with name of CIF

Holder - defaulted

b)

Enter the New CIF ID to be merged (Please note -

Before merging CIF of account, make sure that other CIF which is to be merged

belongs to same customer)

c) Modify a/c name -Yes / No – Account holder name in the

account is to be modified only as per the account holder name in CIF.

d) Reason Code for the CIF merger to be

selected from among 3 reasons listed in searcher

Death Claim transfer

Transfer of certificates

CIF duplicate transfer

e) Once reason is selected, given

account number will get linked to new CIF ID.

CIF Merger Verification

1. Invoke the menu HCCA

2. Select the function Verify

3. Enter the account number for which

CIF merger is done

4. Click on Go

5. Verify the CIF ID details and click

on Ok

Steps for cross verification

Number of

accounts under a CIF (Pre merger)

Post CIF

merger – RD account is merged with the existing CIF

CIF Suspension

CIF which

is not linked to any account is to be suspended using menu CMRC.

Validations

CIF Merger

can be done only in Parent SOL ie where the account stands. If CIF merger for

account is tried in other office, error “Only inquiry is allowed on the

accounts of other SOL” will be thrown.

2. If

the mode of operation of account is 012/999 then it can be transferred to the

new customer if the new customer already is not having the account in the Sol,

with same product group with mode of operation as 012 or 999 and the existing

account should not have any other account in the Sol, with same product group

with mode of operation as 012 or 999.

3.

Only one pension account is allowed for a customer across SOLs.4. For pension accounts, cif to which the account is transferred should not be minor or lunatic. Current cif should not be minor or lunatic.

4. Also mode of operation of 018/019/020 is not allowed for pension accounts.

5. If mode of operation for pension accounts is 016/017 then joint holders are mandatory and should be spouse.

6. If the mode of operation of account is 016/017 if the new customer already is not having the account in the Sol, with same product group with mode of operation as 012 or 999 and the existing account should not have any other account in the Sol, with same product group with mode of operation as 016 or 017.

7. For minor accounts, account can be transferred to new customer if the new customer is also minor and should have guardian. Current cif should also be minor and should have a guardian.

8. For Lunatic accounts, account can be transferred to new customer if the new customer is also lunatic and should have guardian. Current cif should also be Lunatic and should have a guardian.

CommentsComment